Updating the tax code is a major priority for both President Biden and congressional Democrats. At the moment, there are three separate tax and economic bills that have been introduced in Congress — each with the ability to impact a significant portion of the existing tax code.

With so many tax proposals circulating in Washington D.C., we want to focus our attention on the commonalities between these distinct plans, since these areas of “policy overlap” are the most likely provisions to become law.

In this article, we first provide a summary of each plan before sharing the key areas of focus for high-net-worth individuals and their families.

The Biden Plan

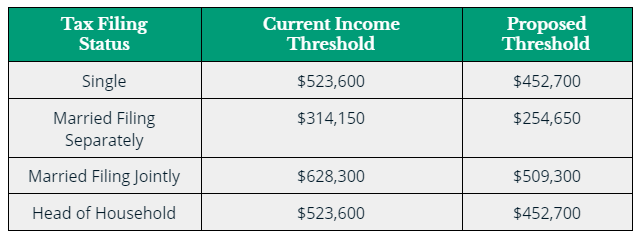

Under President Biden’s proposal (the American Families Plan), the top income tax rate would be increased from 37% to 39.6%, while income thresholds for high earners would be lowered:[1]

The American Families Plan also calls for a number of changes to estate and gift tax laws, including higher estate tax rates; eliminating the basis reset, the preferential capital gains tax rate, and discounted rates; and lowering the estate and gift tax exemptions from $11.7 million per person to either $5.5 million or $3.5 million per person.[2]

The Sanders Plans

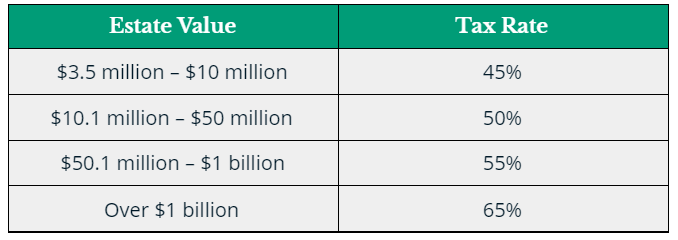

Senator Bernie Sanders has introduced two bills that would dramatically alter the tax landscape for corporations and high-net-worth/ultra-high-net-worth individuals. The first bill would undo former President Trump’s corporate tax cuts and raise corporate tax rates from 21% back to 35%.[3] Sanders’ second bill would create a progressive estate tax that would exempt the first $3.5 million of an individual’s estate and tax anything above that threshold at progressively higher rates:[4]

The Warren Plan

Along with Senators Chris Van Hollen, Cory Booker, Bernie Sanders and Sheldon Whitehouse, Senator Elizabeth Warren has co-sponsored the STEP (Sensible Taxation and Equity Promotion) Act. Like President Biden’s American Families Plan, the STEP Act calls for the elimination of the stepped-up basis for inherited assets.[5]

Warren has also introduced the “Restoring the IRS Act,” which proposes increasing the IRS’ budget from $11.9 billion to $31.5 billion and removing IRS funding from the budget appropriations process to ensure the agency’s funding remains consistent year-to-year.[6]

Clearly, there are a number of differences between each proposal. What follows is a discussion of the common threads connecting these distinct tax proposals and our perspective on how these changes could impact your wealth management strategy going forward.

Basis Reset

Under the current tax code, when an asset is inherited, the cost basis is reset — or “stepped-up” — to the asset’s market value at the time of the previous owner’s passing. (The cost basis can also be “stepped-down” if the asset’s value has decreased since it was first purchased.)

All three of the proposals mentioned above would scale back the basis reset in a meaningful way. And in two of those proposals, death would be regarded as an income recognition event, just like if the original owner sold the asset while they were alive.

So, is it worth moving now to avoid this pending change? In our view, a wait-and-see approach is still the most prudent course of action. Someone holding a portfolio of highly-appreciated company stock has two choices: 1) continue to hold the stock and see if the tax code changes, or 2) sell the stock today with the expectation that changes to the basis reset are imminent.

The first choice allows the individual to maintain flexibility and avoid a taxable event if the changes to the basis reset do not come to pass. The second choice is clearly an income recognition event and would therefore ensure taxation on the appreciation. Of the two options, the possibility of a taxable event (holding the asset) is more attractive than the guarantee of a taxable event (selling the asset preemptively).

In either case, now is the time to explore what you can do if the basis reset does in fact disappear, and our team is here to help you weigh your available options.

The Role of IDGTs

An effective and popular strategy to remove assets from a taxable estate is through the use of Intentionally Defective Grantor Trusts, or IDGTs. Anything placed into an IDGT is removed from the grantor’s estate, but the grantor continues to be the payer of income taxes on those assets. This allows the value of the assets within the IDGT to continue to grow without adding to the estate’s tax burden.

All three proposals mentioned earlier would make a transfer to an IDGT a taxable event. So, in the company stock example from earlier, moving the stock to an IDGT would incur a capital gains tax hit, which would be levied upon transfer of the asset, even if the asset was not technically sold.

One current strategy to consider is an asset swap, whereby any assets that appreciate significantly in an IDGT can be re-purchased by the grantor. This strategy can be used to avoid a taxable event, and our team can provide a custom analysis of your estate if you would like to consider this approach. In the event that changes to the basis step up rules are made, this approach may no longer be available.

Generational Skipping Transfers

A common tool for transferring substantial wealth across multiple generations is an irrevocable dynasty trust. Irrevocable dynasty trusts shift future appreciation of assets to others, while paying only the gift tax cost at current asset values. With a dynasty trust, taxes on the Generational Skipping Transfer (GSTs) only have to be paid once: at the time the assets are transferred to the trust.

All three proposals mentioned earlier have targeted this strategy by suggesting a time limit on how long an asset can be estate tax-exempt. The proposals would require any future transfers made after this time limit expires to trigger a taxable event.

Lifetime Gifting Exemption

At present, the lifetime gifting exemption is $11.7 million per person, as established in the Tax Cuts & Jobs Act of 2017. However, the Tax Cuts & Jobs Act includes a sunset provision: if Congress and the President do nothing to extend the duration of this exemption, in 2026, the exemption will revert to the pre-2017 cap of $5 million.

Under the three tax proposals, it is unlikely that the exemption will extend past 2026; in fact, it is more likely that these proposals would further curtail the lifetime exemption. For this reason, we recommend that clients explore how to capture today’s historically high lifetime exemption cap before it disappears in 2026.

The IRS has already issued guidance that any lifetime gifting done at today’s exemption limit will be grandfathered in; in other words, if you transfer up to $11.7 million today and the lifetime limit reverts to $5 million in 2026, you will not be retroactively taxed on the excess amount in the future. With that in mind, it is safe to assume that you have a limited window to transfer an additional $6.7 million free of estate tax.

Closing Thoughts

There are a number of proposals circulating around Washington, D.C. at the moment, and some of these proposals could significantly impact how your estate will be taxed. However, it’s important to remember that we have seen aggressive proposals from both parties in the past that never came to fruition — historically, without broad-based support from the President and both chambers of Congress, enacting significant changes to the tax code is easier said than done.

For that reason, we encourage clients to take a measured approach to tax planning: by all means, explore the available options and begin thinking about strategic steps you could take, but until these proposals become law, hold off on taking any significant action. If you would like a personalized analysis to help guide you as you weigh your options, we invite you to connect with our team.

ABOUT THE AUTHOR: JEFFREY FOSSELMAN, CFP®, CPA/PFS, JD

As Senior Wealth Advisor for Relative Value Partners, Jeff provides comprehensive advisory services in estate planning, income tax planning, cash flows, asset allocation and other financial planning areas. With more than a decade of experience in the industry, Jeff is instrumental in delivering financial planning strategies and counsel to high-net-worth individuals.

Jeff is also an attorney and has provided basic legal services in the areas of business consultation, formation of legal entities and drafting of estate planning documents.

After graduating with a Bachelor of Science from the University of Illinois in 2000, Jeff continued his studies and earned his Juris Doctor from the University of Illinois College of Law in 2003, and a Master of Science in Taxation from DePaul University’s Charles H. Kellstadt Graduate School of Business in 2010. He is also a member of the American Institute of CPAs – Personal Financial Planning Section and holds a CPA license with a Personal Financial Specialist designation. Finally, Jeff also holds the Certified Financial Planner (CFP®) designation.

Disclosure

Information contained in this article is obtained from a variety of sources which are believed though not guaranteed to be accurate. Past performance does not indicate future performance. This article does not represent a specific investment recommendation.

No client or prospective client should assume that the above information serves as the receipt of, or a substitute for, personalized individual advice from Relative Value Partners, LLC which can only be provided through a formal advisory relationship. Clients of the firm who have specific questions should contact their Relative Value Partners counselor. All other inquiries, including a potential advisory relationship with Relative Value Partners, can be directed here.

[1] CNBC, Biden’s proposed 39.6% top tax rate would apply at these income levels.

[2] Tax Foundation, Details and Analysis of Tax Proposals in President Biden’s American Families Plan.

[3] CNBC, Bernie Sanders introduces bills to hike taxes on corporations and the wealthiest Americans.

[4] NPR, Sen. Bernie Sanders’ Next Progressive Frontier: Reshaping A ‘Rigged’ Tax System.

[5] The Patriot Ledger, The proposed STEP Act and what it means to you.

[6] Bloomberg, Elizabeth Warren Floats $31.5 Billion Plan to Pursue Tax Cheats.

Relative Value Partners merged with Kovitz Investment Group Partners, LLC as of August 2024. All Insights are opinions of the author as of the posting date. Any graphs, data, or information in this publication are considered reliably sourced, but no representation is made that it is accurate or complete, and should not be relied upon as such. This information is subject to change without notice at any time, based on market and other conditions. Past performance is not indicative of future results, which may vary.