The SECURE Act of 2019 made significant changes to the laws concerning IRAs—especially those relating to required minimum distributions, or RMDs—that affect both IRA owners and beneficiaries. Although the law technically went into effect last year, RMDs were suspended in 2020 due to the COVID-19 pandemic, which means 2021 will be the first year that many people will be taking RMDs under the new law.

In this article, we’ll discuss some year-end planning strategies for RMDs and inherited IRAs. Feel free to jump ahead to the section that is most relevant to you.

RMD Strategies

How Are RMDs Calculated?

To calculate an individual’s annual RMD amount, the IRS takes the fair market value of their retirement accounts at the end of the previous year, then divides that amount by the “distribution period” based on the individual’s current age.[1] The older you are, the smaller your distribution period, which means the larger your required minimum distribution for that year.

It is important to remember that annual RMD amounts are not calculated on a per-account basis, but on the overall value of the individual’s portfolio. In other words, if you have three accounts and your total RMD amount is $60,000, you may spread that amount across all three accounts if you wish, or you can draw all $60,000 from one account. The only thing that matters is that the total RMD amount is distributed.

The SECURE Act and RMDs

One of the most significant changes the SECURE Act made was increasing the age at which RMDs are required to begin. Prior to the SECURE Act, RMDs were required to begin at age 70 ½; now, however, individuals do not need to start taking RMDs until age 72. As was the case before the SECURE Act passed, RMDs still must be taken before December 31st.

Many of our clients have asked if they will be required to take RMDs for both 2020 and 2021 if they did not take an RMD last year. The answer is no: RMDs were suspended by the federal government for 2020, so IRA holders will not be expected to “catch up” on last year’s RMD this year.

Tax Planning for RMDs

The penalty for not taking your required minimum distribution is steep: if the RMD amount is not taken in full by December 31st, the IRS taxes the amount not withdrawn at 50%.[2] And while taxes are unavoidable on the RMDs themselves, there may still be opportunities to think strategically about your future tax burden. For example, RMDs can create an opportunity to adjust your asset allocation without generating capital gains tax.

Additionally, if you are still working at age 72, your company’s 401(k) plan can also play a role in your RMD strategy. Company 401(k) plans are not subject to RMDs, and many employer-sponsored plans allow planholders to roll in assets from outside accounts. Therefore, if you are still working at 72, you may be able to transfer your IRA to your company 401(k) plan and avoid the RMD requirement until you’re ready to retire.

Regardless of your unique situation, the team at RVP can help you evaluate your options and think strategically about your RMD for 2021.

Inherited IRA Strategies

The SECURE Act also changed the landscape for inherited IRAs—particularly how these accounts can be managed by IRA beneficiaries. Under the old rules, the inheritor of an IRA could take RMDs over their life expectancy or the original account owner’s life expectancy. As a result, many people chose to adopt the “Stretch IRA” strategy, which works as follows:

- The IRA owner names a young family member as the beneficiary, thereby increasing the life expectancy and lowering the amount that must be taken each year as an RMD.

- This, in turn, allowed the account owner to “stretch” out how long the account could last—and how long assets within the account could continue to grow on a tax-deferred basis.

The new law established by the SECURE Act eliminated required distributions from inherited IRAs; however, most IRA beneficiaries will now have to distribute the entire inherited retirement account within 10 years of the original account owner’s passing. The inheritor can cash out the account however they’d like—10% per year for 10 years; 100% in the first year; 100% in year 10, and so on—which can create a number of strategic opportunities for tax savings, depending on the beneficiary’s age and time horizon.

In previous years, RMDs were not required for inheritors of Roth IRAs, but the SECURE Act has changed that: now, beneficiaries of a Roth IRA only receive the tax benefits of a Roth account for 10 years. While this could make the Roth IRA less attractive than it has been in the past, it may still offer advantages that are worth considering.

Trusts As IRA Beneficiaries

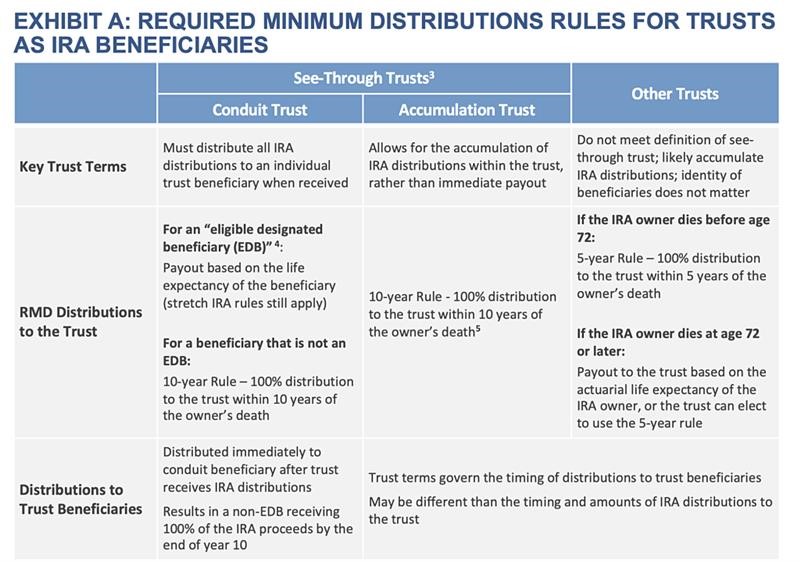

The changes to the law also mean that trusts holding IRAs might potentially be problematic. Trusts are required to have specific language dictating how distributions are to be handled, and this language may no longer align with the requirements under the new laws. This table helps explain the new rules for each type of trust:[3]

Given these new rules and requirements, it is a good idea to evaluate any existing trusts you may have established to handle IRAs. The RVP team can help you determine the best path forward.

Closing Thoughts

The new landscape will likely require some strategic adjustments to your RMD strategy. Whether you’re an IRA owner or a beneficiary, RVP can help you with year-end planning for your RMDs or distributions from an inherited IRA, and we encourage you to get in touch with our team.

ABOUT THE AUTHOR: JEFFREY FOSSELMAN, CFP®, CPA/PFS, JD

As Senior Wealth Advisor for Relative Value Partners, Jeff provides comprehensive advisory services in estate planning, income tax planning, cash flows, asset allocation and other financial planning areas. With more than a decade of experience in the industry, Jeff is instrumental in delivering financial planning strategies and counsel to high-net-worth individuals.

Jeff is also an attorney and has provided basic legal services in the areas of business consultation, formation of legal entities and drafting of estate planning documents.

After graduating with a Bachelor of Science from the University of Illinois in 2000, Jeff continued his studies and earned his Juris Doctor from the University of Illinois College of Law in 2003, and a Master of Science in Taxation from DePaul University’s Charles H. Kellstadt Graduate School of Business in 2010. He is also a member of the American Institute of CPAs – Personal Financial Planning Section and holds a CPA license with a Personal Financial Specialist designation. Finally, Jeff also holds the Certified Financial Planner (CFP®) designation.

Disclosure

Information contained in this article is obtained from a variety of sources which are believed though not guaranteed to be accurate. Past performance does not indicate future performance. This article does not represent a specific investment recommendation.

No client or prospective client should assume that the above information serves as the receipt of, or a substitute for, personalized individual advice from Relative Value Partners, LLC which can only be provided through a formal advisory relationship. Clients of the firm who have specific questions should contact their Relative Value Partners counselor. All other inquiries, including a potential advisory relationship with Relative Value Partners, can be directed here.

[1] IRS, Required Minimum Distribution Worksheets. (Link)

[2] IRS, Retirement Plan and IRA Required Minimum Distributions FAQs. (Link)

[3] Fiduciary Trust, Naming a Trust as IRA Beneficiary: Key Considerations. (Link)

Relative Value Partners merged with Kovitz Investment Group Partners, LLC as of August 2024. All Insights are opinions of the author as of the posting date. Any graphs, data, or information in this publication are considered reliably sourced, but no representation is made that it is accurate or complete, and should not be relied upon as such. This information is subject to change without notice at any time, based on market and other conditions. Past performance is not indicative of future results, which may vary.