Your 20s and 30s are an exciting period, filled with major life events, important milestones, and new experiences. With retirement still 30 or 40 years away, it can be easy at this age to let financial planning and investing become a secondary—or even tertiary—focus.

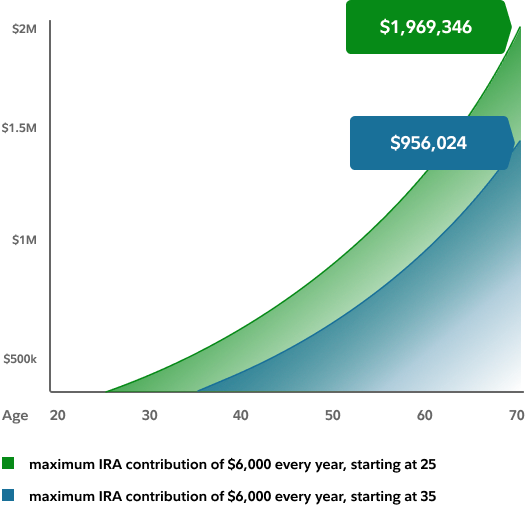

However, building wealth takes time, and thanks to the power of compounding, the more time you can give yourself, the better. The chart below shows the difference 10 years can make: assuming 7% annual growth, someone who starts making the maximum annual contribution of $6,000 to an IRA at age 25 would have about $1 million more in their retirement account by the time they reach age 70 than someone who waits until they’re 35 to start investing[1]:

What does it take to build wealth? A combination of good financial planning and investing habits. In this article, we share the key items that should be on your financial checklist in your 20s and 30s; by focusing on these items, you can set the stage for long-term financial success. As always, we invite you to connect with your RVP advisor if you have any questions about the concepts shared.

▢ Develop a budget and track spending

One crucial step to take as soon as possible—if you haven’t already—is to develop a budget and start tracking your spending. Not too long ago, building a budget meant sitting down and going through each of your monthly expenses, one by one. But that’s no longer the case: with spending programs that your RVP advisor can recommend, it’s easier than ever to keep track of your monthly expenses.

Building a budget helps give you a clearer picture of how much financial flexibility you have, and tracking your spending helps you see where your excess cash is actually going. This process can also help you avoid living beyond your means and it can keep you from incurring unnecessary debt, such as credit card balances, which are easy to run up and not quite so easy to pay off. By developing a budget and tracking your spending, it’s much easier to prioritize the things that matter each month—like saving and investing.

▢ Define your financial goals and begin saving

Once you’ve built your budget, it’s time to define your financial goals and start thinking about how you’ll reach them. Financial goals are typically divided into the following categories, and your personal objectives will likely be a blend of all three:

- Short-Term Goals are for expenses you expect to have within the next three years: a vacation, a new car, new furniture, home upgrades, and so on.

- Mid-Term Goals are for larger expenses with a slightly longer time horizon, typically 3 to 10 years. These kinds of expenses include buying a home, paying for a wedding, or paying off student loans.

- Long-Term Goals are for expenses with a time horizon of 10 or more years, such as retirement, saving for a child’s tuition, or paying off a mortgage.

A key part of working toward these goals is building an emergency fund. Financial surprises (such as losing a job, unexpected medical expenses, or costly home or vehicle repairs) are guaranteed to occur at some point in your life, and having an emergency fund allows you to navigate these periods of tight cash flows while still continuing to make progress toward your financial goals. We recommend that your emergency fund should have enough money in it to cover, at minimum, 3–6 months’ worth of living expenses.

▢ Start investing, with an eye toward retirement

Early in your career, we recommend maxing out your annual contributions to the retirement savings vehicle of your choice. At this stage in your life, you will likely have fewer bills and financial obligations on your plate, and maxing out your retirement contributions will help you capitalize on that. Plus, as we highlighted in the beginning of this article, a five- or ten-year head start on your retirement contributions can make a massive difference to your retirement account balance later in life.

As you get started investing, you’ll need to answer two important questions: What should I buy, and When should I buy?

What should I buy?

As a younger investor, you have a long time horizon to save for retirement, which means you can likely afford to be more aggressive with your investment strategy. For most people in their 20s and 30s, we recommend a stock-heavy portfolio with minimal fixed-income exposure (“fixed-income” typically refers to municipal, corporate, or government bonds, which pay a set yield on a defined schedule—in most cases, every six or twelve months).

We also recommend that younger investors take a broadly diversified approach that includes many different companies across all major sectors of the U.S. and global economy. By taking this approach, your portfolio is driven by the growth of economies around the world, rather than by the success—or failure—of just a handful of individual companies. Many investors use low-cost mutual funds or Exchange Traded Funds (ETFs) to achieve this kind of diversification.

While these are good guidelines as you think about investing, it’s critical that your portfolio matches your personal tolerance for market risk. Our team can help you define your risk tolerance and then build an investment portfolio that is tailored to your objectives.

When should I buy?

One way to invest is by making purchases on a set schedule each month. If you participate in an employer-sponsored plan like a 401(k), this is likely already being done for you. These recurring deposits into an investment account are a great way to “automate” the process of saving for retirement each month.

This set schedule can also help you avoid attempts at market timing, which is the act of trying to enter the market before it goes up and exit the market before it goes down. As noted in David McGranahan’s article linked above, “there is an old saying in wealth management that successful investing is not about timing the market, but about time in the market. This concept is supported by research, and data has continually shown that investors who try to time the market routinely underperform investors who stick to a defined asset allocation strategy.”

▢ Review your insurance needs to protect yourself

Depending on your personal situation, at this stage in your life, the key forms of insurance you should have are health, auto, homeowners/renters, disability, and possibly life insurance.

Most employers offer health insurance, but if yours doesn’t—or you’re self-employed— getting health insurance should be a top priority. If you’re young and healthy you may not think you need health insurance, but medical expenses can happen to anyone at any time.

Insurance isn’t just about protecting your current finances if something happens, either: it also plays a crucial role in protecting your future earning potential. Disability income insurance helps provide valuable protection against lost income: if you became disabled and could only work 30 hours a week, for example, your future earnings would be lowered by the 10 (or more) hours per week you’re no longer able to work. Most short-term disability coverage replaces a certain percentage of lost income for anywhere from three months to one year; long-term disability insurance provides income replacement for a longer period that can range from two years until retirement age. Most employers offer disability insurance, and if yours does, we strongly encourage you to consider signing up for that coverage as soon as possible.

Like disability insurance, life insurance might not seem necessary when you’re young and healthy, but it can be particularly valuable at this stage in life. Life insurance is especially important for people who own a home and are starting a family, as it provides a valuable financial safety net if something were to happen to you. There are various life insurance products to address a wide range of budgets and objectives. Your RVP advisor can provide further guidance.

Finally, liability insurance is also a prudent way to protect your assets from litigation. For example, if you own a home and someone slips on your sidewalk, they could sue you for any medical expenses that may arise from their injury. With the right liability coverage, any damages would be paid out of your policy first, which can help protect your personal assets.

▢ Draft your will, trust, and any powers of attorney

Powers of attorney for property & health care are important, especially once you’re in your 20s and 30s. They may not seem particularly pressing now, but once you’re over the age of 18, your parents can no longer request your health information without your approval. If you have a medical issue and are unable to manage your financial affairs and/or your healthcare needs, someone you appoint can step in to help.

While you’re setting up powers of attorney, you should also take the opportunity to draft a will or a trust. You may not think your estate is worth much now, but if something happens to you and you don’t have a will or trust in place, your family could face a lengthy and stressful probate process to settle your estate. A will or a trust directs who will receive your assets if you were to pass and can also provide for guardianship for your children.

Closing Thoughts

There are a variety of important financial considerations that go into building wealth, and it’s never too soon to start positioning yourself for retirement. If you have any questions about the considerations we discussed in this article, or if you’d like to learn more about how we can help you lay the foundation for long-term financial success, please don’t hesitate to connect with the RVP team.

About the Author: Ruth F. Uress, CFP®

As a Director and Financial Advisor at Relative Value Partners, Ruth F. Uress provides comprehensive financial planning and investment advisory services to individuals and families.

Prior to joining RVP in 2022, Ruth was a Vice President at Brownson, Rehmus, & Foxworth Inc. (BRF). At BRF, she served on the firm’s Financial Planning, Impact Investing, Investment Strategy, and Private Equity Committees.

Her professional experience also includes seven years at Kovitz Investment Group, a boutique Chicago wealth management firm. In this role, she provided comprehensive financial planning advice to clients and chaired the firm’s 401(k) group that was responsible for implementing and monitoring corporate retirement plans. Ruth began her career as a Financial Representative at the Northwestern Mutual Financial Network.

Ruth is a CERTIFIED FINANCIAL PLANNER™ practitioner and earned her Bachelor of Arts in Finance with a minor in French from the University of Illinois at Urbana-Champaign. Ruth is a member of the Ann & Robert H. Lurie Children’s Hospital of Chicago Foundation Legacy Partners and is a former member of the Junior League of Chicago, where she has served on the Board of Directors.

Disclosure

Information contained in this article is obtained from a variety of sources which are believed though not guaranteed to be accurate. Past performance does not indicate future performance. This article does not represent a specific investment recommendation.

No client or prospective client should assume that the above information serves as the receipt of, or a substitute for, personalized individual advice from Relative Value Partners, LLC which can only be provided through a formal advisory relationship. Clients of the firm who have specific questions should contact their Relative Value Partners counselor. All other inquiries, including a potential advisory relationship with Relative Value Partners, can be directed here.

[1] Fidelity, Investing For Retirement (Link)

Relative Value Partners merged with Kovitz Investment Group Partners, LLC as of August 2024. All Insights are opinions of the author as of the posting date. Any graphs, data, or information in this publication are considered reliably sourced, but no representation is made that it is accurate or complete, and should not be relied upon as such. This information is subject to change without notice at any time, based on market and other conditions. Past performance is not indicative of future results, which may vary.