Throughout my career, I’ve focused on fixed income and structured finance. I co-manage RVP’s Durable Opportunities Strategy (previously called Durable Income Strategy) along with Bob Huffman and Maury Fertig. In this short article, we wanted to provide insights on how the strategy is managed and where the strategy fits within a diversified portfolio.

The Strategy At A High Level

The strategy targets income-oriented, exchange-traded securities which include preferred stocks, BDCs, residential mortgage REITs, commercial mortgage REITs, broadly syndicated loans, utilities and pipelines (MLPs) as well as traditional equity REITs. With these holdings, we target 6% to 7% portfolio yield with the goal of generating an additional 1% to 3% through capital appreciation.

Why The Income Is “Durable”

We say that the income is “durable” because over 90% of what we own has a par claim and we put a strong emphasis on owning securities that have a par claim on a particular set of assets.

We also conduct a thorough bottoms-up analysis of the vehicles that we purchase while subjecting the overall portfolio to top-down risk management parameters. In practice, this means that we closely analyze the individual assets within the portfolio while monitoring portfolio macro risk factors that can impact valuations.

How We Manage The Strategy

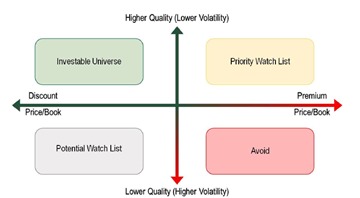

We come in every day and monitor the securities in our portfolios as well as the broader universe of investment opportunities, and we make portfolio adjustments based on our value opinions in conjunction with market opportunities. Most importantly, we look for income-oriented assets that are priced at a discount to net asset value.

We listen to conference calls for the entities that we own, and we’ve gained a lot of insight from being on these calls. We might be one of three or four people on the call, so this information can give us a real edge in the market as many of the securities within the strategy are under-followed and less efficiently priced. Over the years, this has been a source of opportunity for our team and our clients.

Because the strategy is income-oriented, we must defend against duration risk. We do this by paying very close attention to the underlying mechanics of the securities that we own. Today’s portfolio has a lot of floating rate assets as well as higher coupon callable securities that generate attractive income while protecting the portfolio from rising interest rates.

Like all RVP strategies, the Durable Opportunities Strategy invests only in exchange-traded assets and is available to investors in a separately managed account. This differentiates the strategy from hedge funds or limited partner vehicles because we do not lock-up investor’s capital and the underlying portfolios have exchange traded liquidity. We think this distinction is very important and provides our clients with another level of protection.

Where The Strategy Fits In

Relative to conventional bond portfolios, the Durable Opportunities Strategy has a higher risk/reward profile. For this reason, we typically recommend that investors put a portion of their equity allocation into the strategy, as doing so can help reduce overall portfolio risk while generating an attractive current income stream. This is especially true now with equity markets trading at historically high valuations.

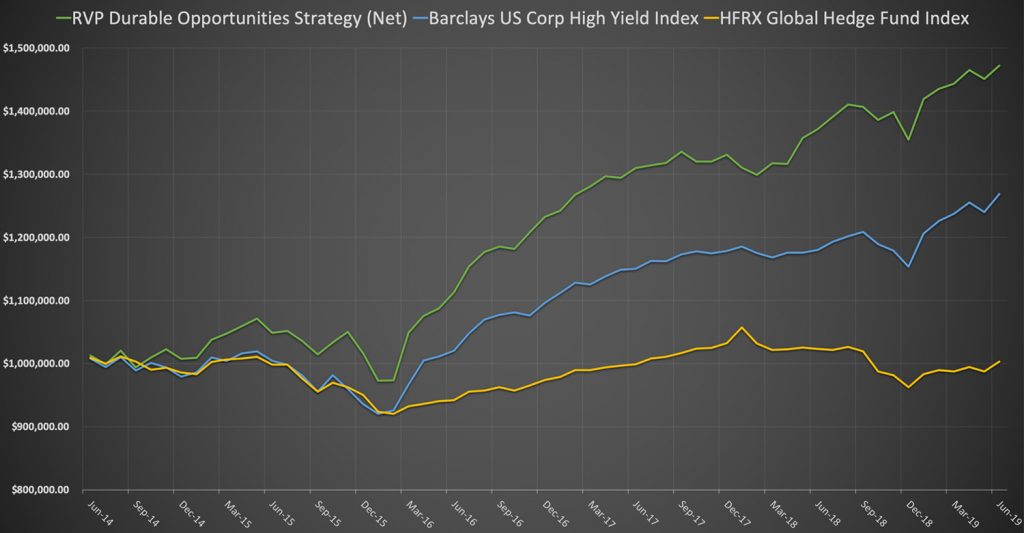

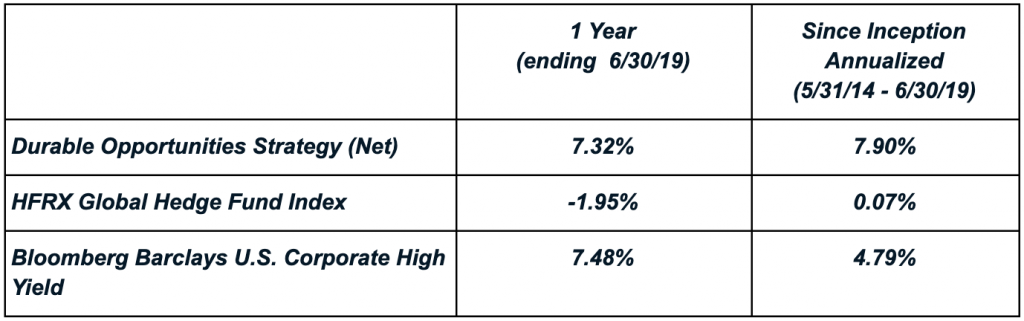

The chart below shows the performance of the Durable Opportunities Strategy since inception.¹

Connect with RVP if you’d like to learn more about the Durable Opportunities Strategy or to see if it can help enhance the risk/reward dynamic of your portfolio.

ABOUT THE AUTHOR: Douglas Crimmins

Doug Crimmins serves as Senior Portfolio Manager at Relative Value Partners. He is the lead portfolio manager on the firm’s Durable Opportunities Strategy.

With more than three decades of experience in the financial services and investments industries, Doug’s specialty zeroes in on fixed income and structured finance.

Prior to joining RVP, Doug worked at Lone Star Funds, a large private equity firm with expertise investing in distressed assets, including residential and commercial real estate, structured credit and corporate loans, as well as Pangaea Asset Management (currently Fortress Investment Group), a bank loan asset manager with a specialty in middle-market loans.

Doug also spent 15 years focused on fixed income sales at Citigroup, and its predecessor firm Salomon Brothers, where he originally worked with co-founders Bob Huffman and Maury Fertig. At Salomon Brothers he worked his way up to lead salesperson for structured credit and private placements, including both origination and distribution.

Prior to pursuing an advanced degree, Doug entered the financial services sector at Blackrock as an associate, where he raised assets and worked on financial advisory assignments. He also had the opportunity to work in Lehman Brothers’ mortgage and financial institutions group as a Financial Analyst.

Doug earned a Bachelor of Arts in Economics from Brown University and a Master of Business Administration with a concentration in Accounting and Finance from the University of Chicago Booth School of Business.

No client or prospective client should assume that the above information serves as the receipt of, or a substitute for, personalized individual advice from Relative Value Partners, LLC which can only be provided through a formal advisory relationship. Clients of the firm who have specific questions should contact their Relative Value Partners advisor. All other inquiries, including a potential advisory relationship with Relative Value Partners, can be directed here.

Important Disclosure ¹

Relative Value Partners Group, LLC Durable Opportunities Composite

Relative Value Partners Group, LLC (RVP) is a registered investment advisor, though registration does not imply a level of skill or training. Prior to July 1, 2015, RVP was known as Relative Value Partners, LLC. The Durable Opportunities Account composite contains fully discretionary Durable Opportunities accounts and for comparison purposes is measured against the Barclays US Corporate High Yield Index, an index of US dollar denominated, high yield, fixed rate corporate bonds. The Durable Opportunities strategy will at times be more volatile than the benchmark which could be perceived as more risk. As of June 30, 2019 RVP adopted a secondary benchmark, the HFRX Global Hedged Fund Index, to the Durable Opportunities Strategy. The HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the Hedge Fund universe. RVP adopted this secondary benchmark because their strategy is an alternative investment strategy. Prior to June 30, 2019, the Durable Opportunities strategy was known as the Durable Income Strategy.

All returns are shown in US dollars and are net of actual fees and all transaction costs. The returns shown include the reinvestment of dividends and other earnings. Accounts may own levered closed-end funds or ETFs and may short ETFs. Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk and there can be no assurances that any specific investment will be profitable. Investors may experience a loss.

RVP claims compliance with the Global Investment Performance Standards (GIPS®). To receive a complete list and description of RVP’s composites and/or a presentation that adheres to the GIPS standards, contact Catherine Goel at (847) 513-6300, or write RVP, 1033 Skokie Blvd, Ste 470 Northbrook, IL 60062, or cgoel@rvpllc.com.

Relative Value Partners merged with Kovitz Investment Group Partners, LLC as of August 2024. All Insights are opinions of the author as of the posting date. Any graphs, data, or information in this publication are considered reliably sourced, but no representation is made that it is accurate or complete, and should not be relied upon as such. This information is subject to change without notice at any time, based on market and other conditions. Past performance is not indicative of future results, which may vary.