A closed-end fund (CEF) is a type of mutual fund. Like most mutual funds, these funds hold a portfolio of underlying stocks, bonds, and other securities. But there are several factors that make these funds unique when it comes to how shares are issued and the price these shares trade at.

How Shares Are Created

A mutual fund manager may create new shares so long as demand exists. CEFs, on the other hand, issue a set number of shares through an IPO, after which no further shares are sold — hence, the fund is “closed-end.”

How Shares Are Priced

Traditional mutual funds are priced at net asset value (NAV) after the market close, while CEFs trade throughout the day. In this way, CEFs are similar to ETFs, but there is one important difference: unlike ETFs, CEFs do not have a “creation redemption feature.”

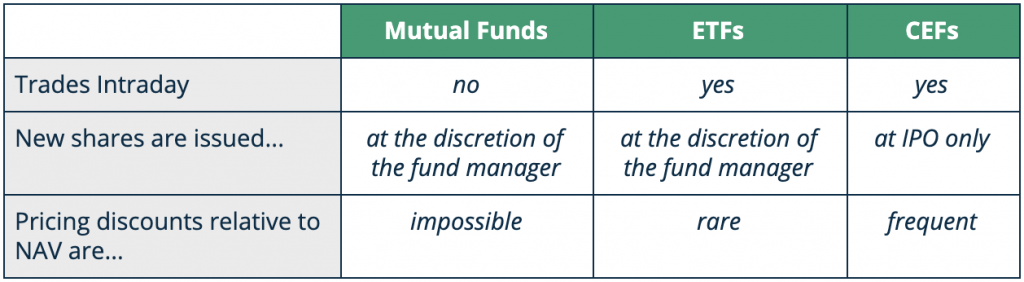

Without this feature, the price of a CEF is driven by supply and demand and, therefore, spreads can occur between a fund’s price and NAV. By comparison, spreads between price and NAV are rare for ETFs. The table below summarizes how mutual funds, ETFs, and CEFs compare.

In our experience, CEFs trading at a discount to NAV can hold opportunities for patient, value-oriented investors.

How Discounts Occur in CEFs

Most closed-end fund IPOs are sold by brokerage firms to their clients as income-generating assets; aside from these retail investors, however, buy-side interest in CEFs within the secondary market can be limited. As a result, when too many shareholders want to exit a CEF, a feeding frenzy can occur, pushing the price of the fund well below NAV.

This can occur at any time during the year, but there are two catalysts that can widen the gap between price and NAV.

#1 – Periods of Market Volatility

During the “taper tantrum” of 2013, when the Fed announced it was slowing down the purchase of Treasury bonds, interest rates shot up, and investors fled from income-generating CEFs. This was an extreme example, but any period of rising rates, concern about rising rates, or market volatility can encourage selling.

#2 – Due to Tax-Loss Harvesting

Tax-loss harvesting can be another driver of CEF discounts. To minimize their tax burden, many investors (or their advisors) sell losing positions at the end of the year to capture capital losses. The pressure to sell into a tepid market can cause discounts to NAV to widen, particularly as the calendar edges closer to the year’s end. Tax-loss harvesting is one of the reasons why we tend to see the widest discounts to NAV around November and the thinnest discounts in March. With the strong year that stocks and bonds had last year, this was not a factor in the fourth quarter of 2019.

What To Keep In Mind

While the CEF market can hold value-investment opportunities, investors should keep a few things in mind before entering the market.

It’s A True Niche Market

The CEF market is $250 billion — roughly the same market cap as Intel. With any niche market, volatility and light trade volume can occur.

Know What You Own

The securities in a CEF’s portfolio vary greatly: some CEFs hold short-term treasuries, while others hold debt from emerging markets. When evaluating a CEF, the fund’s ability to generate yield and preserve capital should be equally weighted.

Look For Investor Activists

Funds trading at a double-digit discount to NAV are worth exploring, especially if institutional traders with a reputation for activism are large shareholders. These investor activists can work on behalf of stakeholders to improve the fund’s price relative to NAV.

Never Buy At A Premium, And Know The Relative Discount

In our opinion, there is never a reason to buy a CEF above it’s NAV. Even buying a CEF that is trading at a discount, but is above its historical discount, should typically be avoided, unless there is a catalyst for the discount to narrow further.

How RVP Can Help

At RVP, we’ve used CEFs within client portfolios since opening our doors in 2004. We’d be happy to discuss your specific investment goals and whether this undercovered market could add value to your investment portfolio.

ABOUT THE AUTHOR: MAURY FERTIG, Co-Founder / Chief Executive Officer

Maury Fertig co-founded Relative Value Partners (RVP) in 2004 with Bob Huffman. Maury serves as the firm’s Chief Investment Officer, overseeing all investment strategies and client relationships, including institutional clients.

Prior to starting RVP, Maury spent 17 years at Salomon Brothers/Citigroup working in Institutional Fixed Income and eventually as Head of Midwest Corporate Bond Sales. He started his career at KPMG Peat Marwick, as a Senior Accountant.

Ingrained in the Chicagoland community, Maury serves as a Vice Chairman of the Board of Directors for the Jewish United Fund of Metropolitan Chicago and is the Immediate Past Chairman of the Pooled Endowment Portfolio Committee. He also held the role of Hillel Board President at the University of Illinois at Urbana-Champaign and is a former member of the international Board of Directors of Hillel: The Foundation for Jewish Campus Life. In 2004, Maury was named an Exemplar of Excellence, an award recognizing individuals whose work for Hillel sets a standard for others to emulate. He also earned special alumni recognition by the Pi Lambda Phi National Fraternity.

Maury is the author of The Seven Deadly Sins of Investing: How to Conquer your Worst Impulses and Save your Financial Future (AMACOM). He has been quoted extensively in business media such as Barron’s, The Wall Street Journal, Bloomberg, Dow Jones and Investment News. He has also appeared on CNBC, Bloomberg Television and Morningstar.com. Additionally, Maury authors a column about income strategies for Forbes.com.

Maury earned a Bachelor of Science in Accountancy from the University of Illinois and a Master of Business Administration from Northwestern University’s Kellogg School of Management. He is also a Certified Public Accountant.

Disclosure

Information contained in this article is obtained from a variety of sources which are believed though not guaranteed to be accurate. Past performance does not indicate future performance. This article does not represent a specific investment recommendation.

No client or prospective client should assume that the above information serves as the receipt of, or a substitute for, personalized individual advice from Relative Value Partners, LLC which can only be provided through a formal advisory relationship. Clients of the firm who have specific questions should contact their Relative Value Partners counselor. All other inquiries, including a potential advisory relationship with Relative Value Partners, can be directed here.

Relative Value Partners merged with Kovitz Investment Group Partners, LLC as of August 2024. All Insights are opinions of the author as of the posting date. Any graphs, data, or information in this publication are considered reliably sourced, but no representation is made that it is accurate or complete, and should not be relied upon as such. This information is subject to change without notice at any time, based on market and other conditions. Past performance is not indicative of future results, which may vary.