A central piece of RVP’s investment commitment is to identify investment opportunities that can enhance the risk/reward profile of client portfolios. Closed-End Funds (CEFs) fit into this investment philosophy because they provide opportunities to buy assets below their underlying value and have other opportunistic features compared to more traditional security types, like ETFs.

In this article, we will discuss why the discount phenomenon may be especially true in the fourth quarter of 2022. If you are already familiar with the mechanics of CEFs, consider skipping to the section titled “Seasonality.” As always, we invite you to connect with our team to discuss the opportunity set and your personalized investment strategy.

What Are Closed-End Funds?

A closed-end fund (CEF) is a basket of stocks, bonds, and/or other securities. The key difference between an ETF or mutual fund and CEFs is how shares are created.

ETF and mutual fund companies may create shares so long as demand exists. CEFs, on the other hand, issue a fixed number of shares through an IPO. Hence, the fund is closed-end.

CEF shares do, however, trade on secondary markets. And because of the defined quantity of shares, CEF share prices are driven by supply and demand, which can lead to large gaps, or “spreads,” between the fund’s trade price and the value of the securities within the fund (known as the fund’s Net Asset Value, or NAV). When the trade price is below NAV, the fund is said to be “trading at a discount”; conversely, when the trade price is above NAV, the fund is “trading at a premium.”

CEFs trading at a discount to NAV can be attractive for value-oriented investors because the discount allows investors to buy this basket of securities at a price below their aggregate intrinsic value. Buying securities below their intrinsic value can enhance the return profile of the investment, as it allows investors to capture:

- a higher yield on the investment than the asset itself;

- potential market appreciation on the asset and share price;

- a narrowing in the spread between the fund’s trade price and NAV, and;

- the possibility of full net asset value realization in the case of a liquidation event.

Not All Discounts Are Created Equal

If you aren’t following the CEF market each day, it can be difficult to discern which opportunities are worth capturing and which ones should be left alone. Here are some of the questions we consider when vetting investment opportunities within this unique corner of the capital markets.

1. What are the underlying assets, and are they suitable to your needs?

A CEF is simply a structure for owning securities. Therefore, the due diligence process should focus on the underlying assets within that structure, not only to ensure that the valuation is attractive, but to ensure that they are an appropriate fit within a larger investment portfolio.

Many CEFs hold debt instruments—such as corporate or municipal bonds—that pay a coupon to the owner. In such cases, the fund itself owns the underlying debt instrument, and coupons are passed along to fund shareholders. CEFs can also use leverage, which can enhance the yield and make CEFs an attractive proposition for income-seeking investors. CEFs can obtain leverage at much more attractive rates (i.e., “lower cost”) than individual investors can.

2. What is the discount to NAV and why does it exist?

The presence of a discount to NAV alone should not be the determining factor in an investment decision.

It’s important to understand why the discount exists and what market factors may be influencing the discount: Is it a term fund (i.e., will the fund terminate at a specified date, whereupon the portfolio will be liquidated)? Is there likely to be a liquidity event? Who else is invested in the fund? Are activist investors involved?

It is also vital to consider the context of the discount: how does the current discount compare to the fund’s historical discounts to NAV? For example, if the fund is trading at a 5% discount today but regularly trades at a 10% discount, the fund is expensive in terms of its discount history; we refer to this as the fund’s “relative discount.”

It is also useful to consider a fund’s discount relative to similarly-invested CEFs. Is the discount wider or narrower than peers’ discounts? Why is that?

Any fund currently trading at a premium to NAV should be avoided, and we generally avoid funds that are trading above their historical discount as well.

3. Seasonality

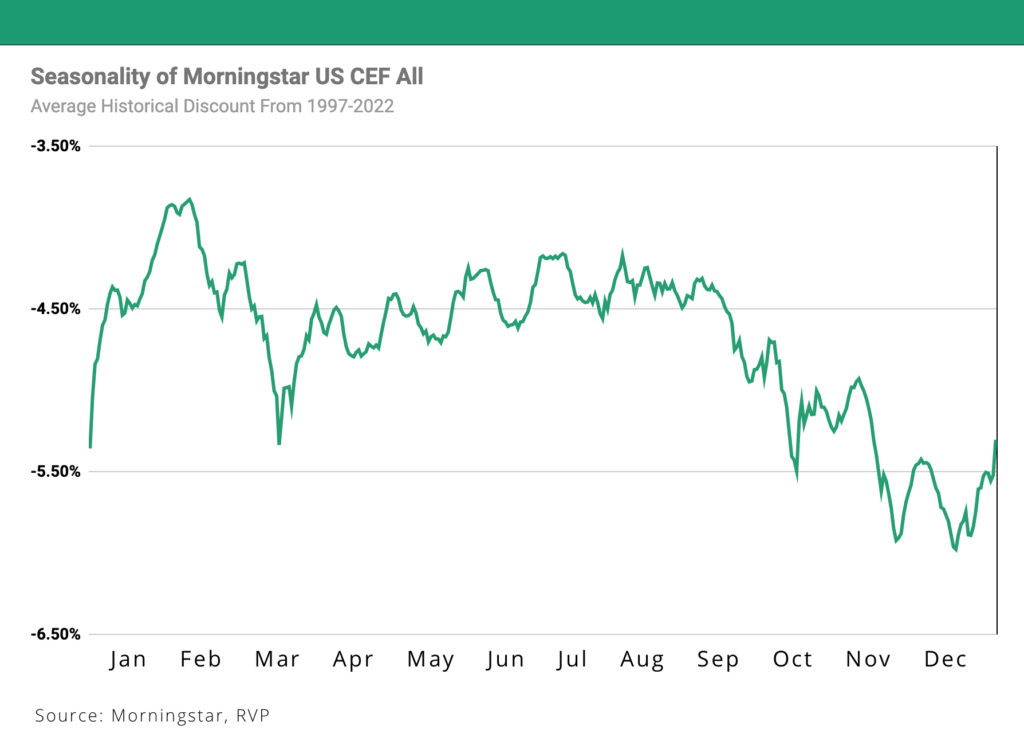

Very broadly speaking, volatility in the capital markets will widen discounts, while buying interest tends to narrow discounts. Over the years, we have observed seasonal trends in the CEF market, as outlined in this chart:

In general, discounts tend to tighten in January and February to start the new year, then widen in March and into April as investors sell shares to pay upcoming tax bills. For the rest of the spring and summer, discount trends are generally dictated by broader market movements: when the market moves higher, we would expect to see spreads narrow, and we expect spreads to widen when markets are trending lower. Again, this is a general observation.

Beginning in September and continuing through November and even December, discounts typically widen as investors harvest tax losses, which necessitate selling positions to capture the capital loss for tax purposes. This brings us to the final point: our outlook for Q4 of 2022.

Our Outlook for Q4 of 2022

We expect to see significant tax loss harvesting (when investors take losses on positions with negative share price returns) in the fourth quarter, since the capital losses are there for most investors to capture. This is a unique circumstance relative to recent memory—in 2019, 2020, and 2021, the S&P 500 traded up by double-digit percentage points[1]—and we expect this selling pressure to widen CEF discounts accordingly during Q4 of this year.

As we noted, the existence of a discount alone should not be the determining factor in CEF investing decisions; however, by evaluating potential opportunities according to the criteria outlined above and other factors, we will be looking for opportunities to add positions with high relative value to client portfolios in the coming months.

Closing Thoughts

If you would like to discuss opportunities in the CEF market, the team at Relative Value Partners can provide a personalized recommendation that is based on your strategy and objectives. We encourage you to get in touch with our team.

About the Authors

Gregory Neer

A Partner and Portfolio Manager at Relative Value Partners, Greg Neer oversees research and analytics. Day-to-day, he takes an active role in building relationships with fund companies, researching individual holdings, identifying new trade ideas, and managing the trading of the strategies. Greg also serves on RVP’s Asset Allocation & Investment Strategy and Operations & Technology Committees.

Greg started his career at Stifel Nicolaus, covering the closed-end fund sector as a Senior Equity Analyst. From there, he moved to Bear Stearns/JPMorgan, becoming a Desk Analyst and proprietary trader, also in closed-end funds.

Greg earned his Bachelor of Science in Business Administration from American University’s Kogod School of Business. He also graduated from Northwestern University’s McCormick School of Engineering with a Master of Science.

Mike Taggart, CFA

Mike is a Vice President on the RVP investment team, where he focuses on investment research and operational efficiencies. He also serves on the firm’s Asset Allocation & Investment Strategy Committee.

Before joining RVP, Mike was a Vice President at Nuveen where he focused on closed-end fund products. Prior to Nuveen, he held several research and product positions at Morningstar and William Blair.

Mike has a BA from Virginia Tech, an MBA from Northwestern University’s Kellogg School, a Masters from University of Illinois at Chicago, and is a CFA® charterholder.

Disclosure Information contained in this article is obtained from a variety of sources which are believed though not guaranteed to be accurate. Past performance does not indicate future performance. This article does not represent a specific investment recommendation.

No client or prospective client should assume that the above information serves as the receipt of, or a substitute for, personalized individual advice from Relative Value Partners, LLC which can only be provided through a formal advisory relationship. Clients of the firm who have specific questions should contact their Relative Value Partners counselor. All other inquiries, including a potential advisory relationship with Relative Value Partners, can be directed here.

[1] Macrotrends, S&P 500 Historical Annual Return (Link)

Relative Value Partners merged with Kovitz Investment Group Partners, LLC as of August 2024. All Insights are opinions of the author as of the posting date. Any graphs, data, or information in this publication are considered reliably sourced, but no representation is made that it is accurate or complete, and should not be relied upon as such. This information is subject to change without notice at any time, based on market and other conditions. Past performance is not indicative of future results, which may vary.