Where will your assets go when you pass on? For every family that we work with, it’s a blend of just three places: assets will flow to loved ones, charitable causes, or the government. How much of your wealth will flow to each will depend on your estate plan and the value of your taxable estate at the time of your passing.

For many wealthy families, strategic gifting — or financial gifts made during their lifetime — is a key tool to gain more control over how their estate will be distributed. And to help think about this process, we built the Decision Tree for Gifting. This resource walks through the key considerations of strategic gifting, and you can click here to download your copy.

Why consider gifting now?

Simply put: because the federal exemption for estate and gift taxes is at a historically high level. For 2022, the lifetime exemption is $12.06 million for individuals ($24.12 million for a married couple). Additionally, guidance has been given that if the exemption is lowered in the future, that the current exemption level will be honored for gifts made now – meaning families can fully use today’s lofty exemption, even if the exemption is lowered by Congress in the future.[1]

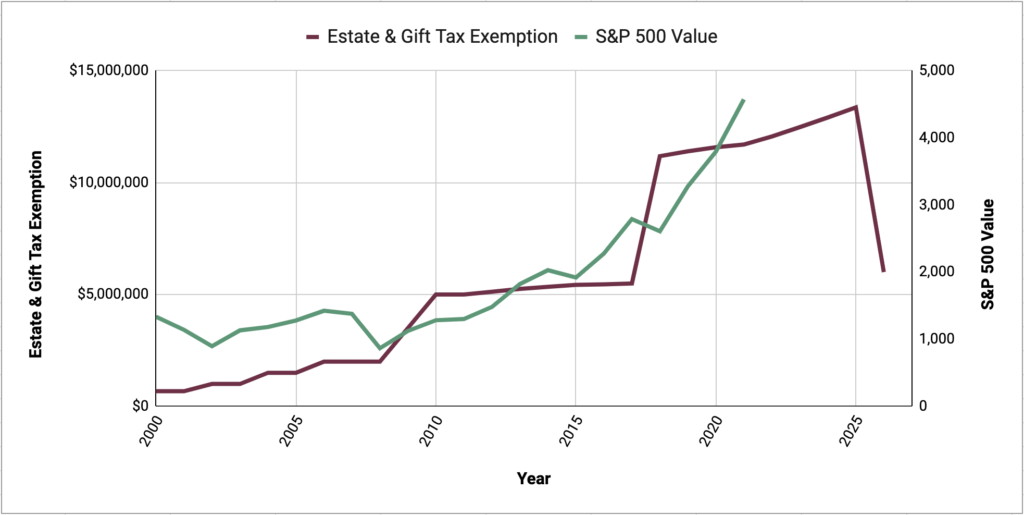

This exemption level is unprecedented in modern history, as evidenced by the chart below. Also highlighted by this chart is the 2026 sunset provision for the current exemption, which is written into law. This sunset provision means that, without legislative intervention, the estate tax exemption will revert to the $5 million per person that it was previously. Adjusted for inflation, this would likely mean a per-person exemption of roughly $6 million in 2026.

The remainder of this article provides some context for the Decision Tree for Gifting and also shares our perspective on several key questions within the resource. As always, we invite you to connect with our team for a personalized consultation as it relates to your estate, gifting, and legacy strategy.

Question #1: Do you have or anticipate having a taxable estate at your passing?

This is, of course, the first question to consider. As mentioned previously, the exemption is $24.12 million for married couples today and will be roughly $12 million for married couples in 2026 without legislative intervention.

Once you have an estimated estate value in mind, you can begin the planning process. If you don’t anticipate having a taxable estate, then there is likely no need (from a tax perspective) to start gifting in excess of annual exclusion amounts. If you do anticipate having a taxable estate, the following questions in the Decision Tree for Gifting can provide some strategic considerations.

Question #2: Do you have an interest in shifting assets to the next generation now?

Many families prefer to share the lion’s share of their wealth at the time of their passing. For others, they prefer to begin shifting assets to the next generation while they are still alive so that they can see and experience the process.

For those that are interested in shifting assets to the next generation now, the first thing to consider is whether you’ve made any gifts in excess of annual exclusion amounts (question #4). If you haven’t made gifts in excess of the annual exclusion, consider developing a gifting strategy from scratch. For those that have made gifts in excess of the annual exclusion, it is important to consider how much of your lifetime exemption amount ($12.06 million in 2022) that you have utilized so far (question #6).

If you haven’t fully utilized your lifetime exemption and you are looking for efficient giving strategies, consider the role that privately held investments can play (question #7). If you are looking for additional ways to give and hold a considerable amount of private investments, a family partnership funded with private investments could be a good option to explore. And if private investments aren’t a key part of your portfolio, consider the role that a Spousal Lifetime Access Trust (SLAT) can play. This vehicle may allow you to shift assets from your estate — thereby reducing your estate tax burden — while still retaining access to your assets in case a sudden financial need arises.

In all cases, our team can be a resource when defining the path forward based on how much you’ve utilized to date and how much you will need to utilize moving forward.

Question #5: Are you charitable or philanthropic inclined?

If supporting a charity or philanthropic organization is important to you, you may want to consider charitable giving techniques such as Donor-Advised Funds, Charitable Remainder Trusts, or even naming a charity as a beneficiary of a traditional IRA.

If you don’t plan to shift assets to the next generation now and are not interested in philanthropic gifting, then the government will likely be a significant beneficiary of your estate upon your passing. If that outcome isn’t desirable, we can help you explore the options that are available and build a customized plan of action.

Closing Thoughts

There are numerous strategies you can use to preserve generational wealth and minimize your family’s estate tax burden. As always, the key is finding the right strategy for your unique situation. We hope the Decision Tree for Gifting can help you explore the options that are available. There isn’t a replacement for a customized consultation, and we invite you to connect with our team to discuss your legacy objectives.

About the Author: Jeffrey Fosselman, CFP®, CPA/PFS, JD

As Senior Wealth Advisor for Relative Value Partners, Jeff provides comprehensive advisory services in estate planning, income tax planning, cash flows, asset allocation and other financial planning areas. With more than a decade of experience in the industry, Jeff is instrumental in delivering financial planning strategies and counsel to high-net-worth individuals.

Jeff is also an attorney and has provided basic legal services in the areas of business consultation, formation of legal entities and drafting of estate planning documents.

After graduating with a Bachelor of Science from the University of Illinois in 2000, Jeff continued his studies and earned his Juris Doctor from the University of Illinois College of Law in 2003, and a Master of Science in Taxation from DePaul University’s Charles H. Kellstadt Graduate School of Business in 2010. He is also a member of the American Institute of CPAs – Personal Financial Planning Section and holds a CPA license with a Personal Financial Specialist designation. Finally, Jeff also holds the Certified Financial Planner (CFP®) designation.

Disclosure

Information contained in this article is obtained from a variety of sources which are believed though not guaranteed to be accurate. Past performance does not indicate future performance. This article does not represent a specific investment recommendation.

No client or prospective client should assume that the above information serves as the receipt of, or a substitute for, personalized individual advice from Relative Value Partners, LLC which can only be provided through a formal advisory relationship. Clients of the firm who have specific questions should contact their Relative Value Partners counselor. All other inquiries, including a potential advisory relationship with Relative Value Partners, can be directed here.

[1] Wall Street Journal, Estate and Gift Taxes 2021-2022: What’s New This Year and What You Need to Know (Link)

Relative Value Partners merged with Kovitz Investment Group Partners, LLC as of August 2024. All Insights are opinions of the author as of the posting date. Any graphs, data, or information in this publication are considered reliably sourced, but no representation is made that it is accurate or complete, and should not be relied upon as such. This information is subject to change without notice at any time, based on market and other conditions. Past performance is not indicative of future results, which may vary.