Private equity funds are long-term vehicles that invest in private businesses with the objective of realizing a return. While private equity is an illiquid asset class, often with a time horizon greater than 10 years, the long-term nature of the investments provides the potential for attractive returns for the patient investor.

At RVP, we strive to add value for our clients by considering strategic opportunities in a variety of asset classes. Read on to learn more about how we view and utilize private equity in a portfolio, and reach out to our advisory team if you’re interested in discussing your unique objectives.

Private Equity: The Basics

Private equity funds are illiquid, long-term vehicles that invest in privately held companies. Private companies stand in contrast to publicly traded companies, whose ownership shares are sold to the public and trade on an exchange such as the New York Stock Exchange. Anyone who is eligible to trade on these exchanges can buy and sell ownership stakes in public companies daily, providing real-time valuations for them.

Private market funds, however, are typically closed-end, drawdown vehicles which have limited windows for investment. Additionally, investors in private equity must be “Qualified Purchasers,” generally meaning they have more than $5 million in investment assets. Transactions in private companies often involve a change of control and take meaningfully longer to execute than placing a trade in public markets.

While there are forms of private equity investing that retain the current managers of a company, typical transactions involve new owners taking over management. In either case, the company will use the influx of capital provided to create value by improving or scaling operations. Unlike publicly traded entities, though, the value of privately owned companies is only updated periodically. Typically, private equity funds also use leverage to enhance returns.

Why Consider Private Equity?

First and foremost, investing in private markets can further diversify portfolios into companies and assets not accessible through public markets. The number of private companies vastly outweighs the number of public companies; in November of 2022, there were 215,000 U.S. privately held companies with revenues greater than $10 million. This compares to just 5,000 U.S. companies listed on major exchanges.[1]

The second factor is the ability to meaningfully influence business operations. Private equity managers, through their ownership interest, can exert significant influence on the capital structure and strategic direction of a business. In public markets, investors often have difficulty exercising control over a company due to a multitude of competing interests.

The next factor is the nature of these investments: Because private equity investments are only periodically valued, they are not subject to the same daily “fear and greed” driven volatility as publicly traded companies. As a result, PE managers are less concerned with short-term results and more focused on long-term value creation.

Finally, investors should consider the “value-add” factor of private equity. Private equity managers often bring differentiated experience to the operations of an existing business. This experience can add meaningful value over the course of an investment period. Managers might develop a strategy for the expansion of new or existing services, use past skills and knowledge to navigate challenging markets, or partner with other portfolio companies to bring additional insight that will help catalyze a business.

Because of all these factors, private markets have historically provided compelling returns relative to public markets over the long run.[2] Moreover, as mentioned in the first point, PE returns are differentiated from public markets and may add diversification to a portfolio comprised solely of publicly traded stocks and bonds.

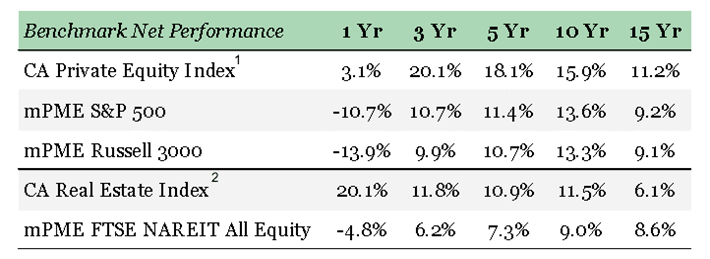

Private Equity Performance Over Different Time Horizons

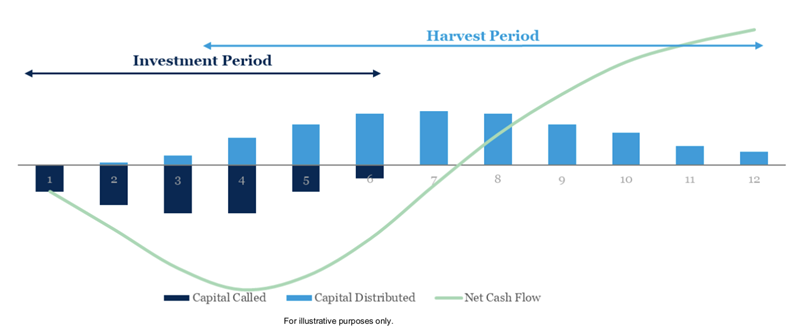

Visualizing The Private Equity Lifecycle

The table above highlights the benefits of private equity investing. The Cambridge Associates Private Equity Index, which tracks the performance of a broad array of private equity funds, has provided strong returns relative to the S&P 500 and the Russell 3000, two popular indices for public market equity performance, over a 15-year period.[3] Additionally, private equity provided meaningful diversification to the Cambridge Associates Real Estate Index and the National Association of Real Estate Investment Trusts (NAREIT) index of equity real estate investment trusts.

Drawbacks to Consider

As they say, there is no “free lunch” in finance. While private equity has many attractive qualities, the addition of PE to a diversified portfolio is not for everyone.

As referenced earlier, the most prominent drawback of private equity is liquidity. Private equity funds are illiquid, long-term investment vehicles that tend to lock up investors’ money for years at a time. It’s not unusual for a private equity investment to require at least a 10-year holding period, including a multi-year investment period followed by several years to make operational improvements.

Additionally, it can take time to sell the company or take it public before realizing any added value. This is part of the reason why PE funds may provide a higher return than publicly traded equities, as fund managers must compensate buyers for the illiquidity inherent in the transaction. This additional compensation is known as the “illiquidity premium.”

The diagram below highlights the life cycle of many private equity investments, with years being shown on the horizontal axis. As you can see, capital is being called and it is not until years seven and eight when the investor receives any sort of return on their investment.

Visualizing The Private Equity Lifecycle

The second drawback can be fees, which may be many times higher than those of funds that invest in public markets. Public markets are much more efficient than private markets, which has led to significant fee compression in recent years. Moreover, there is significant dispersion between the top and bottom quartiles of private equity managers, which can be both a pro and a con. The importance of investing with skilled managers allows those private equity funds to demand higher fees.

It is also important to note that private equity funds can be highly concentrated. Direct private equity funds often own approximately 10 individual investments. An ETF or mutual fund focused on public companies, meanwhile, might own hundreds or thousands of companies (without the responsibility of managing the companies’ operations, of course). Last, but not least, is the topic of Schedule K-1 reporting. Most private equity investments generate a K-1, which adds complexity to the investor’s annual tax filings and may require the recipient to file an extension.

Is Private Equity Right for You?

Due to the illiquid nature of the investments, owning private equity can be a good option for investors who have more liquid assets than they will need for the next decade and are looking to add a new return stream to their portfolio.

It is important to discuss a cash flow plan with your advisor to understand your expected liquidity needs before deciding if private equity is right for you. Our advisor team can help construct a cash flow model for you and your family to determine the liquidity appropriate for your investment portfolio.

How We Implement Private Equity in Client Portfolios

For our clients who incorporate private equity into their portfolios, an allocation between 10% and 20% is typical. For the institutions and certain family offices that we serve, this allocation may approach 30%. There are several implementation approaches to private equity, shown below in order of increasing operational burden and return potential.

Fund of Funds Only

In this approach, an investor holds one or two funds full of PE funds. Benefits of this approach include fewer capital calls, a consolidated reporting structure, and lower investment minimums. Additionally, broad diversification can be achieved quickly. However, this approach introduces a second layer of fees and has the potential to overdiversify, both of which can lower return potential.

Core + Satellite Portfolio

In a core + satellite approach, an investor can use a fund of funds for broad, basic exposure to the asset class while also bringing in several “satellite” commitments into direct PE funds whose managers who are more specialized and provide higher risk/return potential. Benefits of this approach include the diversification inherent with a fund of funds, combined with a mix of greater return opportunities that can come with individual PE fund exposure.

The number of fund commitments, though, will increase complexity. Additionally, direct managers may require higher investment minimums, while funds of funds charge higher fees.

Focused Direct Portfolio

This approach involves multiple commitments to direct private equity funds with a focus on smaller, specialist managers to build diversification within the private equity allocation.

Unlike the two previous approaches, a focused approach benefits from having a single layer of fees. Additionally, investors can concentrate on funds in less efficient parts of the market, which may provide additional opportunities. However, the number of fund commitments needed to achieve broad diversification can increase operational complexity and require higher investment minimums.

Closing Thoughts

For investors who can tolerate liquidity constraints, private equity investments can be an attractive diversifier to public markets. If you are interested in exploring whether or not private equity investments could be right for your financial plan, reach out to the RVP team — we’d be happy to discuss your goals and opportunity set.

[1] Fiducient, Private Markets Education 2023

[2] Fiducient Advisors, Private Markets Education 2023 (link)

[3] The S&P 500 and Russell 3000 return calculations are done in a modified public market equivalent (mPME) manner to address some of the idiosyncrasies of private market return calculations.

Relative Value Partners merged with Kovitz Investment Group Partners, LLC as of August 2024. All Insights are opinions of the author as of the posting date. Any graphs, data, or information in this publication are considered reliably sourced, but no representation is made that it is accurate or complete, and should not be relied upon as such. This information is subject to change without notice at any time, based on market and other conditions. Past performance is not indicative of future results, which may vary.