Throughout history, people have been motivated to extend a helping hand to their families, friends, neighbors, and those in need within their greater communities. These days, many families want to make a positive impact in the world by creating a lasting legacy using their wealth.

However, families with significant wealth often find themselves wrestling with the crucial question of how to maximize the impact of their philanthropic endeavors. While various philanthropic tools are available to facilitate giving strategies, such as direct giving, charitable bequests, charitable trusts, and private family foundations, one method has been gaining prominence – donor-advised funds (DAFs).

Throughout history, people have been motivated to extend a helping hand to their families, friends, neighbors, and those in need within their greater communities. These days, many families want to make a positive impact in the world by creating a lasting legacy using their wealth.

However, families with significant wealth often find themselves wrestling with the crucial question of how to maximize the impact of their philanthropic endeavors. While various philanthropic tools are available to facilitate giving strategies, such as direct giving, charitable bequests, charitable trusts, and private family foundations, one method has been gaining prominence – donor-advised funds (DAFs).

Understanding Donor-Advised Funds

A donor-advised fund is a charitable giving vehicle that allows donors to make irrevocable contributions of assets—such as cash, securities, or other appreciated assets—into a specialized fund. Donors can then direct those contributions to other qualified charitable organizations in the future and invest the funds for growth in the meantime. By allowing a single, deductible donation that can subsequently be distributed to multiple charities, DAFs empower donors to support various causes over time with fewer administrative headaches than with other charitable strategies.Benefits of Donor-Advised Funds

In addition to administrative simplicity, DAFs offer multiple other benefits.Tax Efficiency

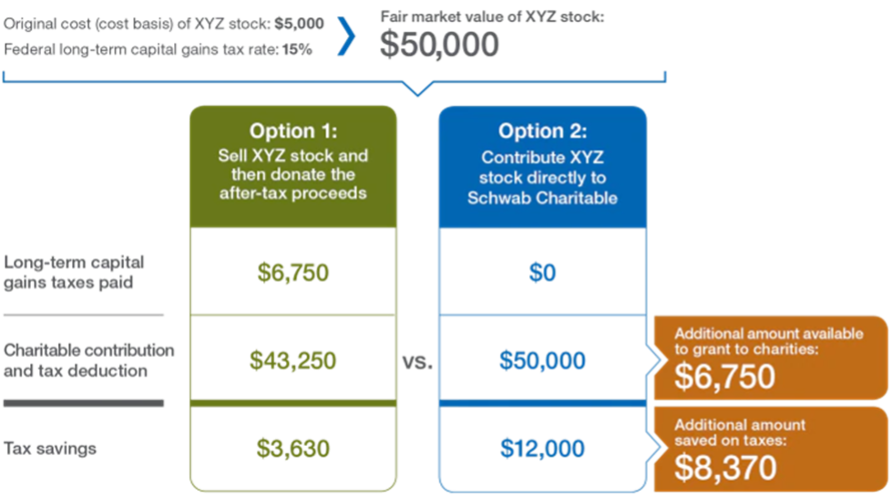

One of the primary advantages of donor-advised funds lies in their tax efficiency. By contributing to a DAF, donors receive an immediate tax deduction, allowing them to maximize the impact of their giving while minimizing their tax liability. Further, donating appreciated non-cash assets can potentially eliminate the capital gains tax that the asset sale would incur. This could increase the amount available for charity by up to 20% (instead of selling an asset, paying taxes, and contributing the remainder).

Donors can also “bunch” contributions by contributing more to a DAF in years where the tax savings are best and foregoing contributions in low-tax years. While donors will get the full tax benefit in one year, they’ll maintain the flexibility to distribute grants to their favorite charities over multiple years. Finally, donations to a donor-advised fund are irrevocable. Since those assets no longer count toward an estate’s value, they aren’t subject to estate taxes.

Confidentiality

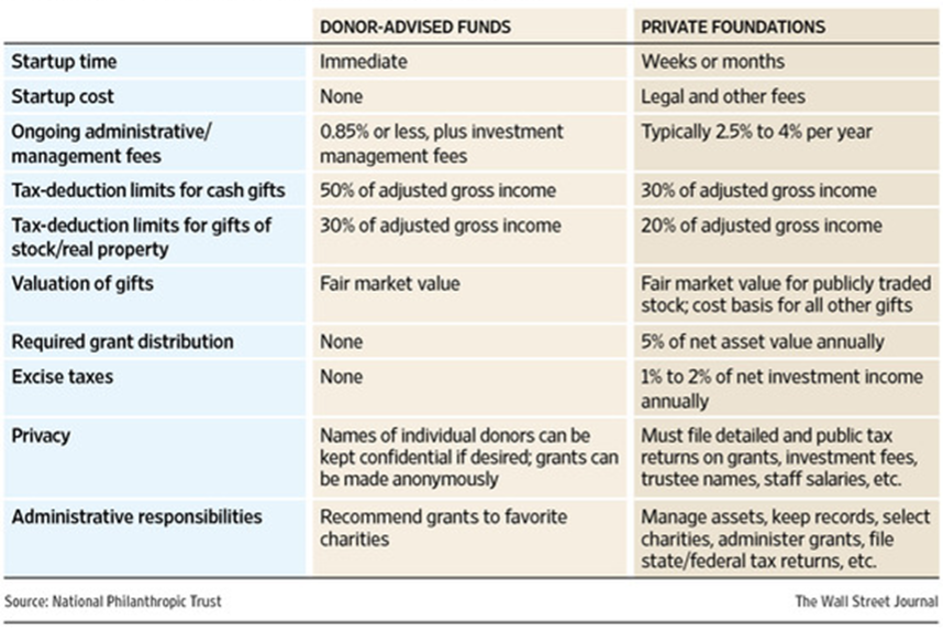

Donor-advised funds offer a discreet alternative for those who value privacy in their philanthropic endeavors. While family foundations require public disclosure of their activities, DAFs allow donors to contribute anonymously, safeguarding their privacy and enabling them to support causes without drawing attention to their personal giving preferences.Streamlined Administration

The administrative burden associated with traditional charitable giving can be overwhelming. Donor-advised funds streamline this process, as the sponsoring organization takes on the responsibility of due diligence, paperwork, and disbursements. DAFs also have no annual required distribution amount, unlike foundations that must disburse 5% of assets each year. The administrative ease of a DAF liberates donors from logistical complexities, allowing them to focus on the strategic and impactful aspects of their philanthropy.Flexibility

Donor-advised funds offer substantial flexibility in donation by allowing contributors to give more than just cash. Depending on the sponsoring organization, donors can also contribute appreciated securities, real estate, and other non-cash assets. This offers a unique avenue for families to align their giving with their overall financial strategy and enhances the scope of philanthropic engagement – allowing creative opportunities for giving.Professional Guidance

Navigating the complex landscape of philanthropy often requires specialized knowledge. Donor-advised funds provide access to professional guidance through the sponsoring organization, which can offer insights into effective grantmaking, investment strategies, and the ever-evolving landscape of charitable giving.How do donor-advised funds differ from private foundations?

Another popular charitable giving vehicle for wealthy families is the private foundation. A private foundation is a not-for-profit organization created by an individual or a family. The foundation is managed by its trustees or directors (often the family), who determine how the funds are distributed. While private foundations have some benefits over donor-advised funds, such as the ability to create direct scholarships/grants for individuals, gift to organizations that do not have the 501(c)(3) designation, and employ a staff to focus on the foundation’s specific mission, we find that donor-advised funds are a better, more straightforward solution for most families. The main differences between DAFs and Foundations can be seen in the table below. The rules around charitable giving can be complex, so it’s best to consult a professional advisor about the best option for your unique situation.

Closing thoughts

As the next step, we urge you to talk to your RVP advisor about your philanthropic goals, options for charitable vehicles, and how charitable giving might fit into your broader financial plan. With the right tools, your philanthropic strategy can become a force for positive change, leaving an indelible mark on the causes that matter most to you.Relative Value Partners merged with Kovitz Investment Group Partners, LLC as of August 2024. All Insights are opinions of the author as of the posting date. Any graphs, data, or information in this publication are considered reliably sourced, but no representation is made that it is accurate or complete, and should not be relied upon as such. This information is subject to change without notice at any time, based on market and other conditions. Past performance is not indicative of future results, which may vary.